The global climate crisis is arguably one of the most pressing issues of our time. And being an archipelago, the Philippines is especially vulnerable to its negative impacts—from rising sea levels to extreme weather events. Having said that, the country faces a pressing imperative to embrace eco-conscious solutions that not only reduce carbon emissions, but also foster resilience and sustainability for future generations.

Against this backdrop, the integration of sustainable housing and electric mobility solutions takes on paramount significance in the local context. From harnessing renewable energy sources like solar power to employing innovative building materials that enhance energy efficiency and resilience, new-age sustainable homes offer a promising blueprint for environmentally responsible urban development.

Simultaneously, the transition to EVs promises to revolutionize transportation infrastructure—curbing air and noise pollution, especially in the big cities. They also require less maintenance, and are inherently more energy-efficient compared to internal combustion engines.

While there is fast-growing interest for greener solutions within the Filipino populace, it seems that the greatest hurdle indeed is affordability. And this is where BPI (the Bank of the Philippine Islands) comes in—as the first Filipino bank to offer a suite of financing options specifically for sustainable solutions. They call this BPI’s Green Solutions.

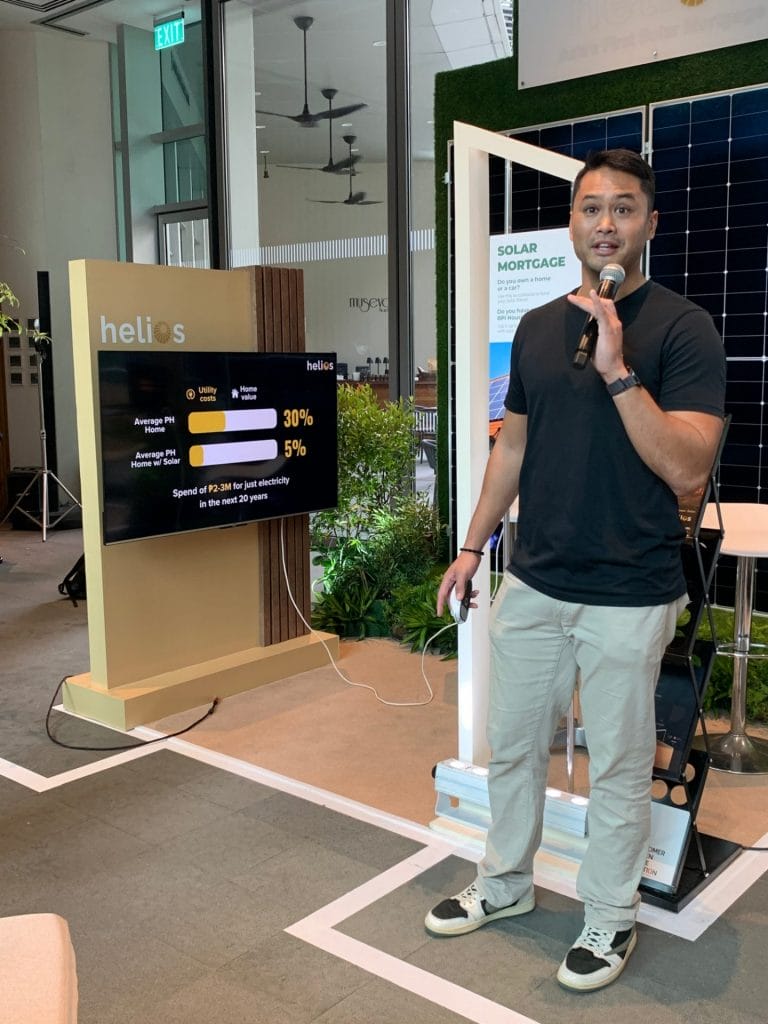

Basically, BPI architectured attractive loans for retail EV financing and green home improvements. Included in the latter are solar mortgages, which enable current clients to use their existing home collateral to install solar panels in their residences.

They also now offer Eco-build financing for people who want to explore building more sustainable spaces.

“BPI Green Solutions represents a pioneering step in sustainable financing, providing customized solutions for Housing and Auto Loans to make sustainable homes and e-vehicles more accessible and affordable to the market,” shared the Head of BPI Retail Lending and Bancassurance, Dexter Lloyd Cuajotor, at their press conference held at the Ayala Museum last week.

Cuajotor furthered that while it is the initial investment cost that seems to be the greatest barrier for Filipinos looking to adopt a greener way of living, BPI aims to provide Filipinos with better access to such sustainable products and services by offering its flexible payment options, which will be enhanced with further discounts during BPI’s All Out Promo period, which will run until March 31.

BPI, as a company, is also committed to sustainability, as reflected in its Green Solutions initiative. They are especially proud of their bank-wide sustainability mandate, which is a first of its kind in the local banking scene.

Even before the pandemic, BPI already expanded its Green Financing programs and rebranded it as its Sustainable Development Finance (SDF) program. Included here are the likes of sustainable agriculture, renewable energy, energy efficiency implementation, and climate resilience. These were carried out as part of the bank’s commitment to the United Nations Sustainable Development Goals (UN SDGs).

It’s great to see that the green movement is gaining traction in the Philippines. Let’s all strive to make this a greener and healthier planet to live in!